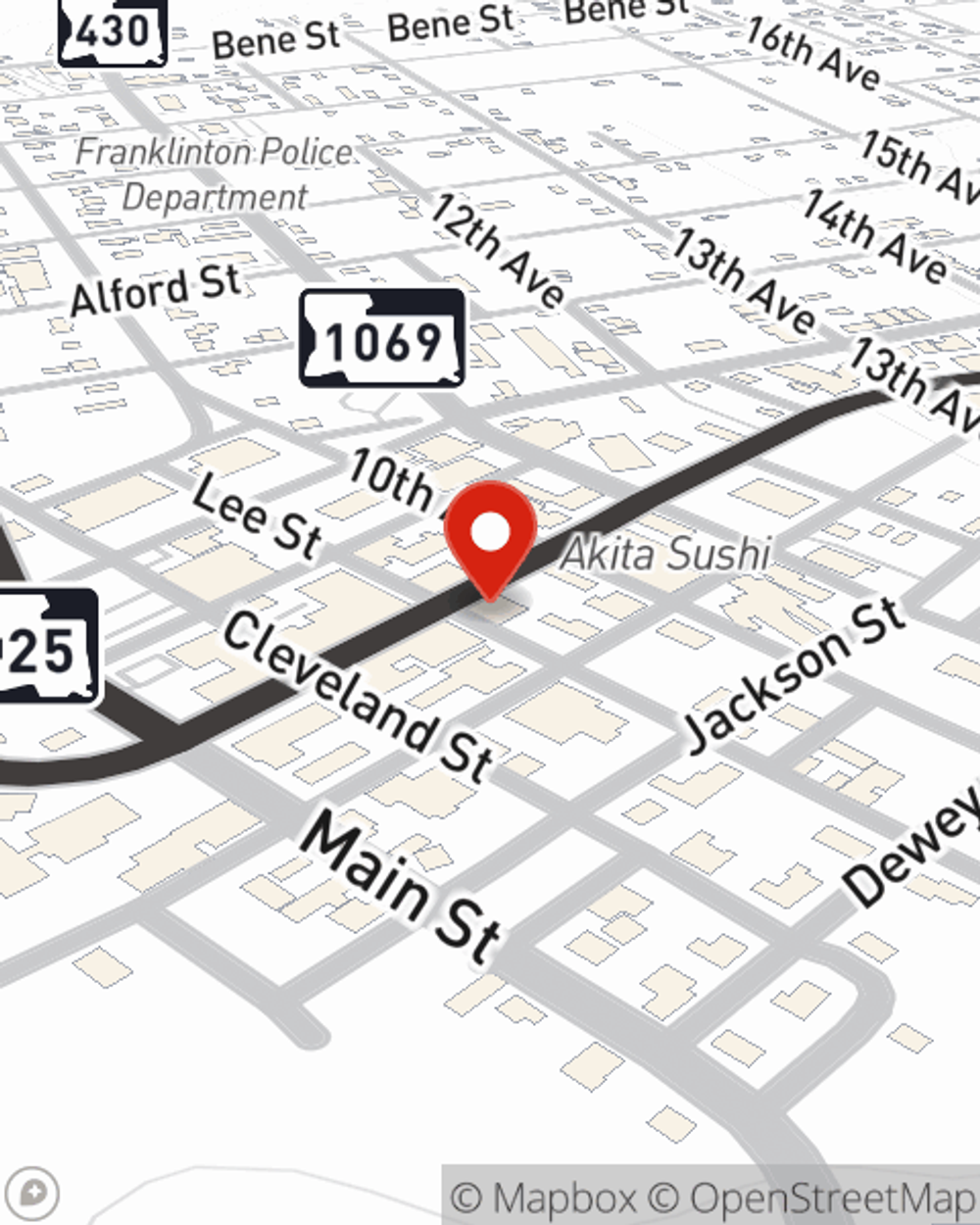

Life Insurance in and around Franklinton

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Do you know what funerals cost these days? Most people aren't aware that the normal cost of a funeral today is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the people you love cannot pay for your funeral, they may fall on hard times following your passing. With a life insurance policy from State Farm, your family can maintain their quality of life, even without your income. Whether it maintains a current standard of living, pays for college or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Protection for those you care about

Life happens. Don't wait.

Life Insurance You Can Trust

And State Farm Agent Laurie Bell is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Simply talk to State Farm agent Laurie Bell's office today to learn more about how a company that processes nearly forty thousand claims each day can help cover your loved ones.

Have More Questions About Life Insurance?

Call Laurie at (985) 839-4152 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Laurie Bell

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.