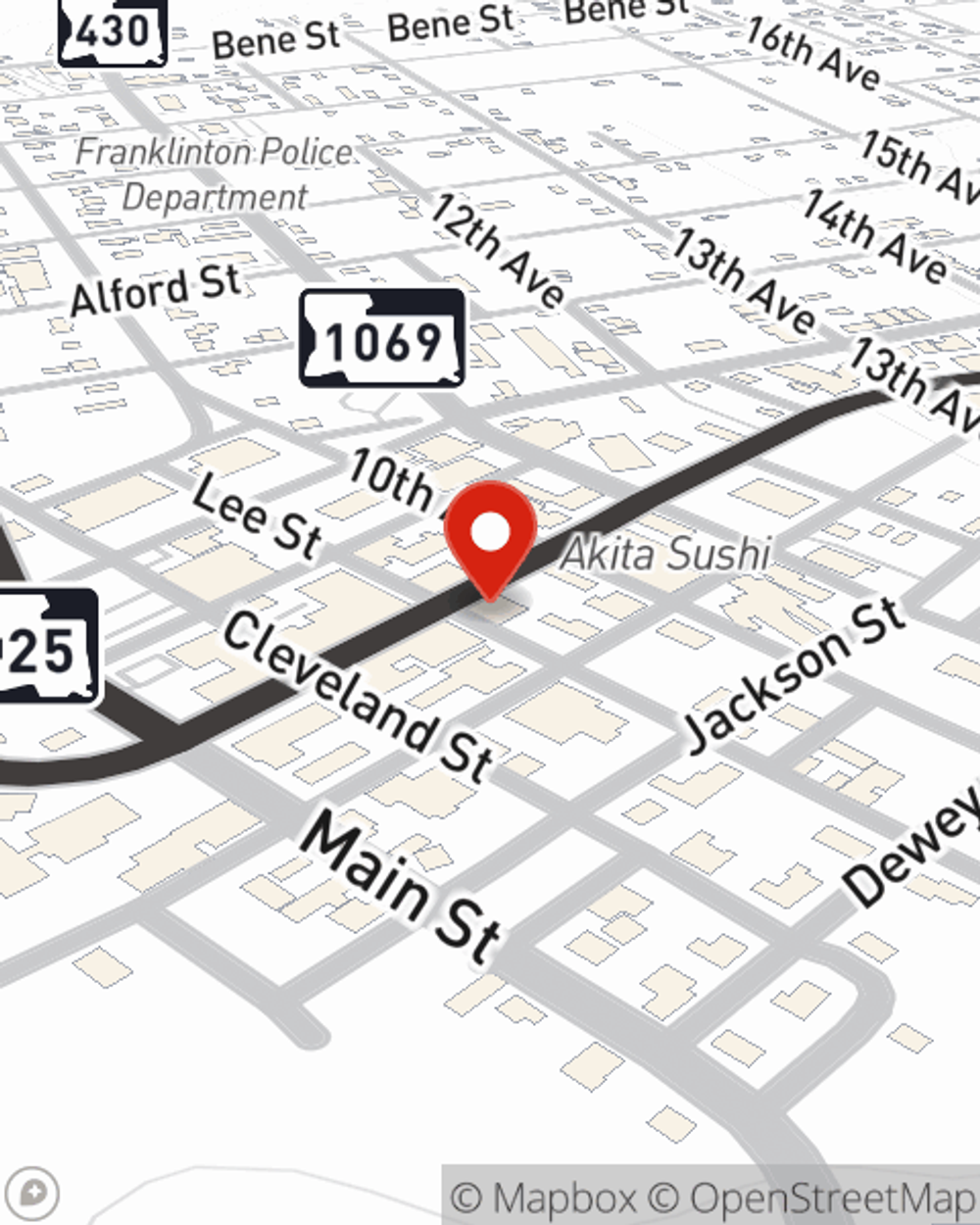

Business Insurance in and around Franklinton

Searching for insurance for your business? Search no further than State Farm agent Laurie Bell!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Running a small business requires much from you. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, trades and more!

Searching for insurance for your business? Search no further than State Farm agent Laurie Bell!

Helping insure small businesses since 1935

Customizable Coverage For Your Business

Your business thrives off your passion tenacity, and having fantastic coverage with State Farm. While you make decisions for the future of your business and do what you love, let State Farm do their part in supporting you with commercial auto policies, business owners policies and worker’s compensation.

Let's chat about business! Call Laurie Bell today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Laurie Bell

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.